September 21, 2011 by akhilendra

Stock pick for long term -HDFC

As we have stated in our earlier posts that current market conditions are extremely good for portfolio building. Some of the very good stocks are available at very attractive price ranges. One of them is Housing Development Finance Corporation ltd. HDFC is one of the most prominent players in housing loan industry.

It is very aggressive and balanced in their growth plans and have consistently grown itself into the one of the biggest player in the industry. Interest rates and other factors are uncertain and there would be a sense of uncertainty among investors for this sector, but as it has got a very sound balance sheet and loan book, it seems to be in a very good position to take itself forward from here.

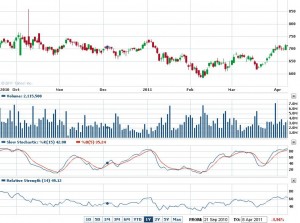

HDFC is currently trading at Rs 674.10 at NSE. Its long term chart is in a very good shape and indicators are aligned for its long term growth. It is a very good stock from long term and one can expect very good returns over a period 1-3 years from now.

When we look at the long term stock, we look at the sector and the company. housing loan industry and HDFC both seems to be made for each other. Real Estate demand is not going to die soon in India and most of the buyers go for home loans. So there is huge potential for the housing loan companies to grow and HDFC is going to be the one of the biggest beneficiary of this demand.

thestockmarketbasics.com">Colin - June 24, 2013 @ 12:05 am

Thanks for the pick bud, be sure to grab up a few shares

staralliancecapital.com">Antony Skafidas - October 11, 2011 @ 9:41 pm

This particular is perhaps the most sensational blogging I have browse in a really extended time. The quantity of related information in here’s fantastic, like you practically authored the book on the topic. Your blog is great for any one who desires to understand this unique subject more. Awesome information; please keep it up!