December 26, 2010 by akhilendra

MACD

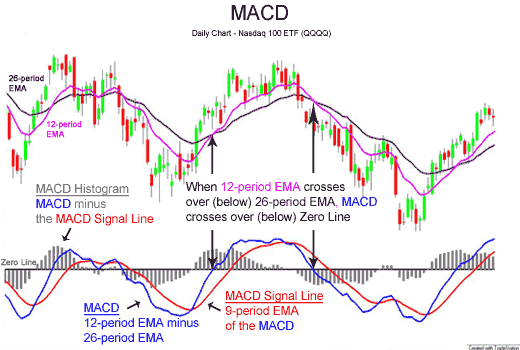

MACD which stands for moving average convergence divergence is momentum indicator. it is a trend following indicator that is based on two moving averages of prices. The MACD measures the divergence and convergence between a shorter term moving average and longer term moving average. MACD is the difference between two moving average. it measure trend and momentum, where momentum shows the strength of the trend.

It is created by calculating a 12 day EMA and a 26 day EMA of closing price. The 26 day EMA is then subtracted from the 12 day EMA and the difference is plotted as solid line. This is known as fast line and then a slow line is plotted as a dashed line. MACD is drawn in two form;

1. The line form

2. Histogram

How to use it;

1. if MACD is greater than zero, it means that the short term average is higher than the longer term average, signaling an up trend.

2. If MACD is less than zero it suggests a down trend.

yahoo.com">Jacie - January 17, 2012 @ 2:59 pm

Intelligence and simplicity – easy to undetsrand how you think.